- #Free budgeting software 2019 how to

- #Free budgeting software 2019 registration

- #Free budgeting software 2019 free

If you’re a homeowner and your property taxes are not included in your mortgage payment, divide those taxes by 12 and add that amount to your mortgage to make sure your property taxes are covered in your monthly budget. Mortgage or Rent: Enter the amount of your monthly mortgage payment in the mortgage box, or the amount of your monthly rent in the rent box of the budget calculator. This budget calculator guide will walk through each section, step by step. The rest of the budget maker is dedicated to capturing your monthly expenses.

#Free budgeting software 2019 how to

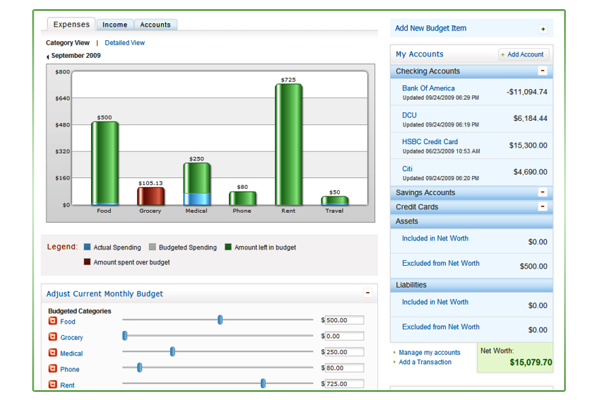

Step 2: How to determine and enter monthly expenses You can also use this section to add a second income if you’d like to create a joint budget. If you have additional income such as a side job, child support, alimony, or other supplemental income, add the monthly amount you can spend in the monthly budget calculator under Other Income. If the last 3 months were unusually high or low, add up all your deposits for the past year instead and divide by 12 to get a better average. Enter that amount in the budget calculator. If your income changes from month to month, add up your total monthly deposits for the last 3 months and divide that number by 3 to get a monthly estimate.If you get paid every other week, multiply your take-home amount by 26 for the number of checks you get each year, and then divide by 12 to get your monthly take-home pay.If you get paid twice a month, add the take-home amount of your two checks together and enter that amount.If you get paid a regular check once a month, simply enter the take-home amount of that check.To determine what to enter under Salary/Wages in the budget calculator: Net income is what you actually bring home after taking out taxes and any paycheck deductions for things like your retirement or your health insurance plan. Gross income is what you make before anything is deducted from your paycheck. This will be the amount you can spend every month, so be sure to use your net income, not your gross income. The first step in the monthly budget calculator is to determine your monthly income. "emergency fund" a budget item and contribute small amounts monthly until the fund is large enough to serve as aīuild your budget in 4 easy steps Step 1: How to determine and enter your income

Your emergency fund should contain enough money to pay your bills for three to six months. You can prepare for the unexpected by creating an emergency fund with sufficient cash to carry you through hard

To school, include contributions to funding these goals in your monthly budget.Įmergency Planning: Prepare for the Unexpected For example, rather than fantasize about buying a home or going You plan to do, you aren\'t likely to do them. If you aren\'t saving money for the things This kind of expense-tracking exercise shows how even little costsĬreating a budget forces you to reevaluate your goals and priorities. One benefit of building a budget is that it forces you to track your spending and see in black and white (or in Getting this done by doing all the math for you.

#Free budgeting software 2019 free

Quicken\'s Free Budget Calculator gives you a boost toward

#Free budgeting software 2019 registration

Transportation includes not just your carīut gas, insurance, registration and repairs as well.

Or rent as well as utilities when you list an amount for housing. Categorize expenses in groups to make the process simpler. Take the time to add up your total monthly income from all sources and list your regular monthly expenses toĪ monthly budget. With Quicken\'s budget calculator, it\'s easier than ever to manage your When it comes to personal finance, it\'s best not to play the guessing game.

0 kommentar(er)

0 kommentar(er)